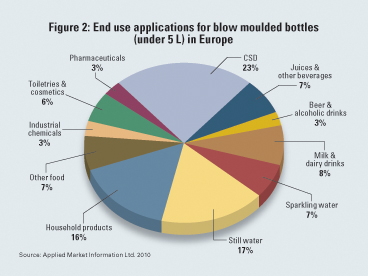

Demand for flexible packaging chemical polyethylene terephthalate (PET) witnessed growth of around 7% compound annual growth rate (CAGR) last decade, due to its diverse application in a wide range of new products developed by fast moving consumer goods (FMCG) and food sector companies, according to chemicals intelligence provider GBI Research. The research analysis indicates that fast-growing economies and strong production industries will lead Brazil, Russia, India and China (BRIC) to become dominant forces in the global PET market. A significant portion of demand for PET came from the Asia-Pacific region, which accounted for 40.6% of global PET demand during 2010. This is expected to increase to 47.8% by 2020, as China is rapidly emerging as a global petrochemical products manufacturing hub. Production in China enjoys the advantage of relatively low operating costs and, as a result, there have been huge capacity PET capacity additions in the country, with the country accounting for almost half of Asia-Pacific's import volumes during 2010. China is anticipated to be the PET market leader towards 2020 due to major PET players focusing their operations within the country. The announcement of anti-dumping duties on imports from other regions, alongside significant capacity additions, means that Brazil and Russia's PET markets are also expected to expand towards 2020. In addition, India's large population is causing consumption of packaged goods to rise, creating increased demand for PET capacity additions. Flexible packaging will continue to grow in importance as major retail chains demand greater product protection and longer shelf-life for various products. Carbonated soft drinks (CSD) accounted for an impressive share of 31.5% in the demand for PET during 2010, while the food and beer sectors accounted for respective shares of 22.4% and 11.4%. According to GBI Research's analysis, PET packaging is expected to increase its share in the packaging sector towards 2020 due to better gas barriers and ultraviolet (UV) light protection, which extends the shelf-life of PET-packaged products, while new hot-filling processes are creating new opportunities for PET packaging for pasta and sauces. During 2011, beer distilleries also adopted PET bottles for use as packaging, which is expected to continue towards 2020 due to advantages in product quality, transport and bar regulations concerning the use of glass in outdoor areas. Global PET demand stood at 6,472,350 tons in 2000, increasing at the CAGR of 6.9% to reach 12,621,553 tons in 2010. This upward trend is expected to continue in the near future, with global PET demand tipped to reach 23,452,281 tons by 2020, following a forecast CAGR of 6.4%.

Growth opportunities for blow molders, especially those in PET, are in no short supply. Research from Applied Market Information (AMI) suggests that the latent potential for PET barrier bottles in beer, wine, and milk is equivalent to the current size of the carbonated soft drinks (CSD) market for PET bottles in Europe, which was just under 1 mln tons in 2009.

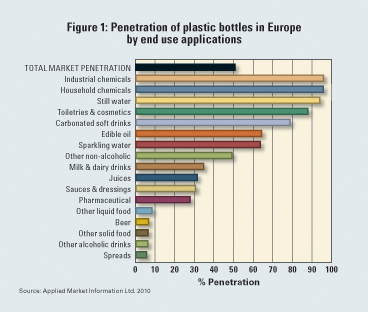

Glass is reaching its limits in terms of light-weighting, and there is growing doubt among brand owners about its ability to evolve with market needs. The growing emphasis on the carbon footprint of packaging supply and end-of-life management will prove a compelling competitive advantage for plastic packaging. In particular, PET will present an increasingly persuasive case in terms of sustainability, technical performance, and aesthetics. The future growth of the blow-molded bottles business in Europe will increasingly be driven by the growth in PET packaging in new markets. The potential in beer and alcoholic drinks is highlighted by the low penetration achieved to date with plastic bottles, estimated by AMI to account for just 7% of the packaging

for these products in Europe

While PET bottlers have long coveted these markets, without ever achieving that step-change breakthrough, there is now a growing interest in and acceptance of PET for beer and other alcoholic drinks driven by three things: the improved economics of bottle production compared to glass, PET’s favorable LCA, and the growing emphasis on pack weight reduction. One liter-plus PET bottles are already widely used for beer packaging in Eastern Europe, and here their market penetration is close to 45%. PET bottles work in Eastern Europe because they do not require the same shelf life as in Western Europe. Beer packaged in PET is generally consumed within five weeks. However, the monolayer bottles used incorporate an O2 scavenger to support a four month-plus shelf life to minimize the risk of spoilage. In Western Europe, PET beer bottles are predominantly used for sizes of 500 ml and below. These can be found in Germany, Switzerland, France, Spain, Italy, and Scandinavia. The drivers behind the introduction of beer in PET bottles in Western Europe have been legislation, the environmental lobby, and the wholesale movement to PET bottles for one-way packaging in Germany. The Western European brewing industry favors integrated blow molding and filling of one-way PET bottles as the most effective production strategy. However, this is still more expensive than one-way glass bottles, which continues to suppress penetration levels.

Over the long term, demand is expected to be buoyed by:

• The improving economics of PET, through raw materials cost reduction and production efficiency and scale, making pricing comparable to glass bottles

• The favorable LCA of one-way PET versus glass

• The growing emphasis on and commercial benefits of pack weight reduction.

Even so, it is likely to take PET some time yet to knock glass off its perch. At AMI, we forecast the demand for PET bottles in this market to advance at around a rate of 10% annually in these applications over the next three to four years.

Other opportunities are expected to emerge in food markets, where plastic bottles have yet to make a major impact. The constraint thus far has been the simple fact that high-speed hot filling and retort technologies used to package food already exist for jars, cans, and cartons. However, plastic bottles are expected to be able to make penetration gains over the next few years thanks to growing investment in aseptic cold filling, improved barrier monolayer PET bottles, and the sustainability argument. For example, jam in PET is well established in the U.S., and Europe is expected to see an increasing number of introductions in squeezable PET bottles for this product over the next five years. The U.K. enjoys the highest penetration level of squeezable bottles for jam in Europe, where they are already widely used for tabletop sauces. Within the rest of Western Europe, steady penetration gains in sauces and spreads will underpin demand growth, while demand in Central and Eastern Europe will evolve with the further development of the packaged goods industry. The universal driver is user convenience in terms of squeezability, dosage control, ease of handling and safety, and pack light-weighting initiatives.

While beer and solid food markets represent large, untapped opportunities for plastic blow-molded bottles, for now the blow-molded bottles market is still largely driven by developments in the mineral water and household chemicals markets, where plastic bottles account for more than 90% of the packaging used. In these markets, the trends are more about inter-material competition, with growing volumes of recycled PET being used in mineral water bottles and growing use of PET bottles in household chemicals packaging thanks to a reduction in the price point of PET versus high-density polyethylene and a growing preference for clear packaging to display the product. Within the bottled water industry in Europe, glass bottles are still used for premium brands served at restaurant tables. However, the development of premium, glass-like PET resins promises to open this niche to plastic bottles over the next five years, as a lightweight, shatterproof alternative with greater scope for design flexibility.

Product developments in sparkling waters will direct bottle engineering projects toward barrier performance (CO2, O2, vitamins, natural flavorings) as opposed to light-weighting initiatives, which will favor lighter-weight monolayer solutions over heavier multilayer bottles. In household chemicals, the trends are about inter-material competition. High-density polyethylene is the dominant polymer within this market. However, with the substantial reduction in price differential between polyolefins and PET, PET bottles continue to grow their market penetration. Colgate-Palmolive was the first to switch to PET, and Procter & Gamble too has converted all dishwasher products and fabric conditioners to PET bottles in Europe, substituting HDPE. Yet within these companies, the balance of polymers is still broadly 75:25 in favor of HDPE versus PET. This presents a significant substitution opportunity for PET in applications and bottle sizes that don’t require a handle or are not subject to tight cost constraints. While growth prospects in general may be promising, the business remains challenging for raw material suppliers and converters alike in Europe. The forward focus for fillers is resource-efficient supply, driving the market toward on-site manufacturing options, be it HTW (hole-through-the-wall), self manufacture, or blow molding of preforms. This is limiting the ability of traditional converters to add value, while for European resin suppliers, this is mainly a commodity business increasingly threatened by cheaper Asian and Middle East imports. The competitive nature of the business is driving consolidation throughout the supply chain and the top 10 molders accounted for one-third of polymer conversion in Europe for blow-molded bottles in 2009. Alpla is the clear market leader. Other major blow-molding groups that operate a network of HTW or in-plant operations for the major food and drink companies include Logoplaste, Serioplast, Nampak Plastics Europe, and Graham Packaging. In PET preforms and bottles, the leading company is Artentius PET Packaging, which acquired Amcor’s PET business in Europe in 2007.

(Author : Carole Kluth of AMI Ltd.)