The demand for automotive plastics which was reported at US$15.1 bln in 2012 is expected to be worth US$32.9 bln by the end of 2018, Tranparency Market Research, Asia Pacific had garnered the highest revenue share in the global automotive plastics market in the year 2012. Growing automotive demand, especially from developing markets, coupled with a strong trend to reduce vehicle weight is expected to drive automotive plastic demand in the near future. The automotive plastics market was dominated by Asia Pacific, which accounted for more than 50% of the total consumption by volume in the year 2011. This growth is primarily driven by the huge demand for automobiles in the rapidly developing economies within the region. Combined with improved design capability and the enormous reduction in weight and emissions, plastics have become one of the most important and indispensable materials in automotives and are expected to enjoy this market superiority in the coming years.

The instruments and technology used in designing and manufacture of automotive plastics in their various application segments are extremely cost intensive and this is one of the main drawbacks as it discourages new players from entering the fray. Raw materials for automotive plastics are majorly sourced from petroleum products and this has a direct impact on the price of finished products as the raw material prices are volatile and subject to the variation in crude oil prices. The automotive plastics are used in various automotive components such as bumpers, seating, dashboards, upholstery, internal, and external trims. The researches on composite materials, reinforced plastics, and polymers have come up with improved material qualities that make them suitable for use in interior, exterior, and under bonnet components of automobiles. The careful selection of these automotive plastics enables designers to improve durability, meet load bearing requirements, and achieve reduction in vehicle weight. As of year 2011 Asia-Pacific leads automotive plastics consumption volume by 52% followed by Europe (29%), North America (10%), and rest of the world (9%). Plastics find major applications in electrical components and interior and exterior furnishings of automobiles. The majority of the application market for automotive plastics is under the purview of these two application segments accounting for almost 70% of the total consumption. Plastics are also used in other parts in automobiles such as power trains, under the hood and chassis. The market for these applications is expected to show growth over the forecast period. Polypropylene (PP) has been the most widely used plastic in automobiles in recent years and is expected to hold sway for the entirety of the forecast period till 2018. Polyurethane (PU), acrylonitrile butadiene styrene (ABS), polyvinyl chloride (PVC) and polyethylene (PE) are the other major plastic materials that have been in great demand in automobile manufacturing. Polycarbonate (PC), polymethyl methacrylate (PMMA), polyamides (PA) such as nylons and other plastics including polyoxymethylene (POM) and polyethylene terephthalate (PET) are also in great demand in various automotive applications. Polypropylene leads consumption by 36% followed by polyurethanes (17%), ABS (12%), composites (11%), HDPE (10%), polycarbonates (7%), and PMMA (7%) due their easy forming properties and their availability at cheaper price than other materials.

Agricultural films are gaining importance with the advent of high technologies in agriculture and emphasis on higher productivity per hectare. High growth in global population is one of the biggest challenges for the agriculture industry, which has led to increased focus on agricultural productivity. The major purpose of using agricultural films is high sustainable production on limited arable land. The use of agricultural films for controlled agriculture has helped in increasing the yields on the limited arable land with limited irrigation water. The three major applications of agricultural films are greenhouse, mulch and silage. The arable land is decreasing gradually with drastic increase in urbanization. Controlled agriculture becomes important in order to utilize significant resources like water for irrigation in an optimum manner. This is consequently increasing the importance of controlled agriculture in greenhouse, high tunnel and mulching. Agricultural films is a billion dollar market which is expected to reach US$7.1 bln by 2017 at a CAGR of 6.7% from 2012 to 2017. Currently, mulch films and greenhouse films are the major application segments which are expected to boost the global market, as per MarketsandMarkets.

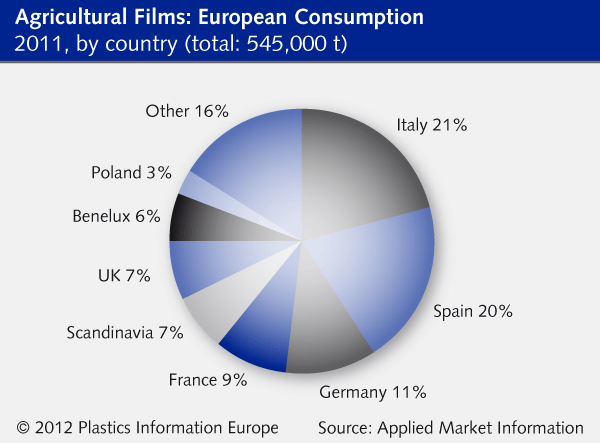

The European agricultural films market is worth EUR 2 bln, accounting for over 540,000 tons of polymer-based films every year, as per Applied Market Information. The report says that over the past 60 years agricultural output and productivity have increased significantly, with plastic agricultural film for silage, mulch and greenhouse use making a substantial contribution to continuously increasing yields. However, the business is challenging and there are many conflicting trends. For example, population growth and rising per capita calorie intake demand greater food production, but the amount of farmland and number of farms is falling. Reductions in dairy herds may lead to a decline in silage films in one area, while growth in biomass crops may create opportunities in another. Italy accounted for the largest share, closely followed by Spain. Germany and France were also leading consumers in a market that includes the EU 27 as well as Switzerland and Norway.

While plastic films contribute to improved efficiency and output, there are increasing concerns about film waste and disposal, leading to growing interest in the use of biodegradable materials. Climate change may extend the opportunity for plastic greenhouses further north, while at the same time existing users will demand more durable, longer lasting films to cut costs. In addition, a new group was recently formed within the European Association of Plastics Recycling and Recovery Organisations to come up with solutions for agricultural waste disposal, as per Plasteurope.com. AMI says the overall result of these trends is a market that is showing very little growth in volume terms, but which will still present opportunities for film producers to develop better performing films in areas such as barrier, thermal, visual and photo-selective properties. The market is mainly in the Mediterranean region with Spain and Italy taking the lead, particularly in consumption of greenhouse and mulch films. In the long term, however, AMI expects demand for agricultural films to grow more strongly in countries in northern Europe, boosted by climate change and the demand for higher crop yields. With almost half of the European market, silage film is the largest segment. Greenhouse film represents around 30% of the market, consisting of film for classic greenhouse structures, macro tunnels/walking tunnels and low tunnels and floating/direct covers. Mulch film represents the remaining 25% of Europe's agricultural film demand and is expected to show a small overall decline due mainly to replacement by biodegradable types and, where feasible, downgauging. For players in the market, the business is a challenging one with many conflicting trends. On the one hand, population growth and rising per capita calorie intake demands greater food production; on the other, the amount of farmland and number of farms is declining. While plastic films can undoubtedly contribute to improved efficiency and output, growing concerns about film waste and disposal is leading to growing interest in the use of biodegradable materials. Reductions in dairy herds may lead to a decline in silage films in one area; growth in biomass crops may create opportunities in another. Climate change may extend the opportunity for plastic greenhouses further north, while at the same time existing users will want more durable, longer lasting films to cut costs. Currently the overall impact of these various trends is a market which in volume terms is showing very little growth but which will still present opportunities for film producers to develop better performing films in areas such as barrier performance, thermal, visual and photo-selective properties.