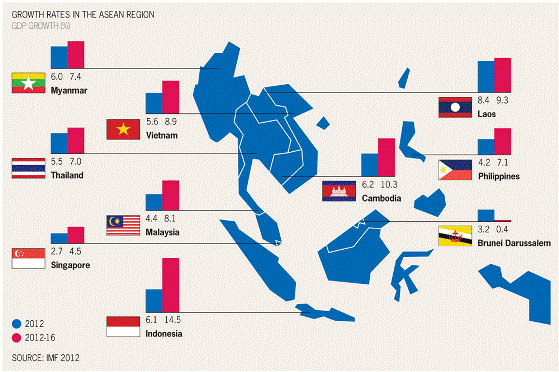

Polyolefin demand grew by 15-20% in Indonesia and Vietnam during 2012, with the rest of Southeast Asia (SEA) enjoying a strong year, as per ICIS. The polypropylene industry in Southeast Asia is growing at a much faster pace than the polyethylene industry. The demand for polypropylene in the region has grown at a healthy rate and is expected to continue the good run in the coming years. The main sectors driving demand for polypropylene are packaging and automotive. The demand for flexible food packaging has been driving packaging sector in the region. Automotive production in the region is also growing at a good pace, creating a backward demand for polyolefin resin, which are used to make interior as well as exterior auto parts. The opportunities for further growth seem huge, not just in SE Asia, but in other emerging economies in Asia.

Growth in SE Asia consumer spending along with polymer consumption from a comparatively low base - has partly been driven by the wealth effect of booming property markets.

In Indonesia, property prices have quadrupled over the past five years in US dollar terms. Also, in a few districts of Thailand, the value of condos has reportedly doubled in just three years.

Some SE Asian plastic converters that diversified into land speculation are said to have made a fortune by subdividing their land and selling it on to property speculators. Comparisons are being drawn with the credit-fuelled economic boom that preceded the 1997-1998 Asian financial crisis. The difference this time is that most of the debt being piled up is in local currencies. In 1997-1998, the problem was that the majority of borrowings were offshore, in US dollars, and so when confidence evaporated, local currencies collapsed and individuals and companies were left insolvent.

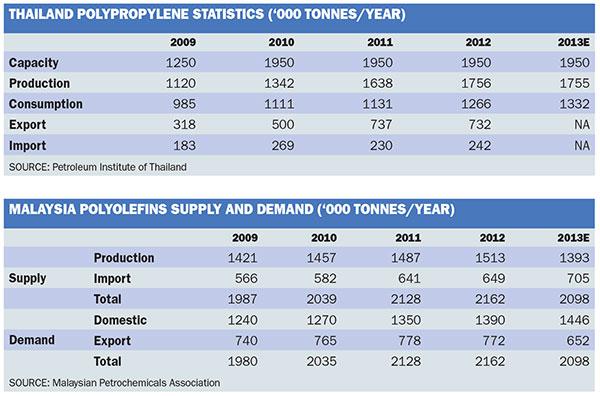

However, some of the recent spending by SE Asian governments on infrastructure is viewed as a means of compensating for the slowdown in export trade. Infrastructure spending is another factor behind the region's economic success story. Doubts also exist over whether Malaysia, Thailand and Singapore - the three heavily export-trade-dependent economies in SE Asia - can prosper in the long term if the external economic environment remains weak, no matter how much money is spent on local infrastructure. China and its economic rebalancing continue to cause concern in the region. Neighbouring economies like Malaysia have gained a lot from China's GDP growing at 10% pa or more. News that China is forecast to grow at much less than 10% pa as it restructures its economy, has cast a shadow on the economic future of SE Asian countries dependent on China. The table from the Malaysia Petrochemicals Association (MPA), shows that the country's polyolefins industry depends on exports. In 2008-2012, Malaysia was a net exporter of polyolefins, with destinations including China, other SEA countries and India.

Indirectly, Malaysia's chemicals and polymers industries also feed into the country's heavy reliance for growth on overall exports. Similarly the fortunes of Thailand’s petrochemicals industry are directly and indirectly dependent on exports. The table from the Petroleum Institute of Thailand shows how polypropylene (PP) exports have soared since 2009. Thailand is also heavily reliant on exports to China. One Thai producer has been forced to reduce polyethylene (PE) exports to China from 30-40% in 2012 to just 10% so far this year. Some Thai producers have managed to fully compensate for the slowdown in China by raising exports to other SE Asian countries and to Latin America. But with US capacity set to substantially increase over the next few years, several industry sources believe that the Latin American market will no longer be viable for Asian exporters.Thailand, as with Malaysia, is also heavily reliant on overall exports to drive its economy. Out of a total Thai GDP of US$366 bln in 2012, exports accounted for US$226 bln, according to the CIA World Factbook. In an ever-more complex and interdependent world, it seems as if SE Asia is particularly vulnerable to what happens elsewhere.

Per capita polymer consumption in countries such as India and Indonesia has a long way to go before it catches up with the west and developed Asian economies such as Taiwan and South Korea, as per India's Chemicals and Petrochemicals Manufacturers' Association as reported by ICIS. As per an HSBC report on the Philippines; the country faces considerable challenges. Infrastructure in much of the country remains poor and corruption is widespread, despite progress under the president's administration. Growth has generated pockets of urban prosperity surrounded by vast areas of grinding poverty and few jobs.” An IMF report suggested four ways in which Asia’s emerging economies, which they categorise as China, India, Indonesia, Malaysia, the Philippines, Thailand and Vietnam, can avoid the middle-income trap.

They are:

• Invest in infrastructure. IMF analysis suggests that subpar infrastructure is a key factor that can check an emerging economy’s growth. India, the Philippines and Thailand are particularly exposed in this area and should focus on building new and upgrading existing public transit systems, freight channels, ports and energy infrastructure.

• Guard against excessive capital inflows. Money flows from abroad can energise an economy and give domestic consumption a boost, but can send an economy south if investors retreat in a hurry. Policy makers should have macro-prudential controls in place to mitigate potential rapid outflows.

• Boost spending on research and development and post-secondary education. Both are needed to foster the innovation that’s a hallmark of advanced economies. Malaysia and Thailand have the highest college enrollment rates among emerging Asian economies, but China is rapidly catching up, according to IMF data. China far outstrips other developing Asian countries on R&D, with 2009 spending at more than 1.5% of GDP.

• Get more women into the workforce and raise the retirement age. Ageing populations are a problem in much of Asia. Governments can take steps to reduce “dependency ratios” by raising the age when workers are eligible for pensions and encouraging girls to enter university and vocational training.