Global demand for electronic smart packaging devices is currently at a tipping point and will grow rapidly from US$0.03 bln in 2012 to US$1.7 bln in 2022. The electronic packaging (e-packaging) market will remain primarily in consumer packaged goods CPG reaching 35 billion units that have electronic functionality in 2022.

The electronic packaging (e-packaging) market will remain primarily in consumer packaged goods (CPG) reaching 14.5 billion units that have electronic functionality in 2023, as per a report by IDTechEx. The key enabling technology - printed electronics - is about to reduce costs by 99%. Consequently, many leading brand owners have recently put multidisciplinary teams onto the adoption of the new paper thin electronics on their high volume packaging. It will provide a host of consumer benefits and make competition look very tired indeed. This is mainly about modern merchandising - progressing way beyond static print - and dramatically better consumer propositions. E-packaging addresses the need for brands to reconnect with the customer or face oblivion from copying. That even applies to retailer own brands. It addresses the ageing population's consequent need for disposable medical testers and drug delivery devices. Electronic packaging addresses the fact that one third of us have difficulty reading ever smaller instructions. The rapid growth will be driven by trials now being carried out by leading CPG companies and the rapid technical developments emanating for over 3000 organisations, half of them academic, that are currently working on printed and potentially printed electronics. The main factors driving the rapid growth of electronic smart packaging are:

- Ageing population

- Consumers are more demanding

- Consumers are more wealthy

- Changing lifestyles

- Tougher legislation

- And concern about crime and the new terrorism

With adoption of electronic smart packaging, brands can create a sharp increase in market share, customer satisfaction and profitability. The major factors driving the growth of smart packaging concepts in today’s market:

- Strong consumer interest in convenience, safety, health, and product security;

- Share growth of private label products and low priced brands across most categories;

- Brand proliferation and desire/need by marketers to differentiate their offerings;

- Brand marketer focus on packaging as a key source for innovation;

- Retail channel fragmentation and growth in specialty stores and channels;

- Rise in product counterfeiting and theft, particularly of high value products;

- Ageing population and need for additional product/package functionality;

- Growth in supply chain management systems that are based on RFID;

- Globalization of supply base, which requires more packaging security;

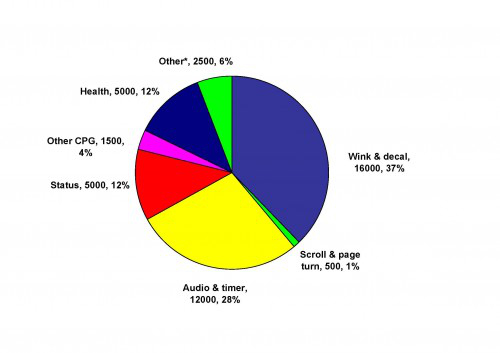

The E-Packaging Market in 2022 - total market value US$1.7 bln

- Winking and decal refers to labels that wink an image on and off and reprogrammable decoration on mobile phones etc

- Scrolling and page turn refers to text and graphics accessed by scrolling or page turning

- Audio and timer refers to voice, music or alert sounds including those produced by timers or sensors

- Status refers to visible indication of status as with the tester on a battery case and an indication of how much is left in an aerosol can

There will also be growth from existing applications such as talking pizza boxes, winking logos on multipacks of biscuits and bottles of rum, compliance monitoring blister packs in drug trials, prompting plastic bottles of drugs that prompt the user, testers on batteries and reprogrammable decoration on mobile phones. However, IDTechEx's projected adoption only represents a few percent of CPG packages being fitted with these devices in 2022. There are still many challenges to be addressed, including creating sustainable e-packaging products rather than one-off projects. Cost and lack of integrators and complete product designers are current limitations.