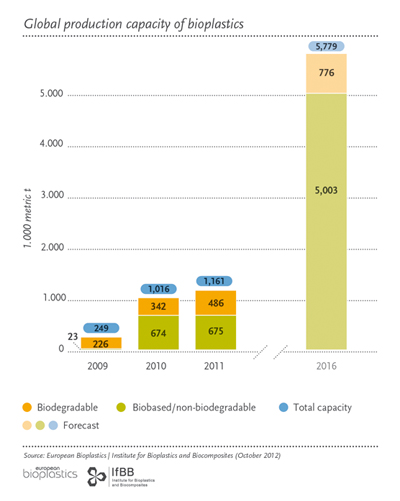

The bioplastics market of around 1.2 mln tons in 2011 will see a five-fold increase in production volumes by 2016 – to an anticipated almost 6 mln tons. This is the result of the current market forecast, which the industry association European Bioplastics publishes annually in cooperation with the Institute for Bioplastics and Biocomposites from the University of Hannover. By far the strongest growth will be in the biobased, non-biodegradable bioplastics group. Especially the so-called ‘drop-in' solutions, i.e. biobased versions of bulk plastics like PE and PET, that merely differ from their conventional counterparts in terms of their renewable raw material base, are building up large capacities. Leading the field is partially biobased PET, which is already accounting for approximately 40% of the global bioplastics production capacity.An increasing number of new bioplastic production facilities are being built in Asia and South America. In 2016, Asia is predicted to be home to 46.3% of the global bioplastic production capacity, and South America to just over 45%, driven mainly by feedstock availability. Thailand has expressed the ambition to become bioplastics production hub of Southern Asia, and is taking concrete steps in the form of investments and joint ventures to realize this. In Brazil, world number one in bio-PE production Braskem has targeted 2013 as the year to bring its bio PP facility on stream. Other factors impacting growth include robust market demand growth, relative scarcity of oil & gas and supportive government policy in most countries of the region. These regions are also less likely to have large fossil energy discoveries or feel any major supply impact of the large shale gas discoveries in North America.

Global Production Capacity :

Palm waste and palm oil are found in abundance in Malaysia as well as Indonesia. New developments in Malaysia focus on jatropha development, and the Petronas/LanzaTech project that is aimed at utilizing waste CO2. Malaysia's pioneer Bioplastics Pilot Plant that enables the production of versatile biodegradable plastic materials from palm oil - a fully automated Polyhydroxylalkanoate (PHA) Bioplastics plant was designed and built through the partnership between SIRIM Bhd, Universiti Sains Malaysia (USM), Universiti Putra Malaysia (UPM), and the Massachusetts Institute of Technology (MIT),United States. The bioreactor facilities and integrated manufacturing process of the plant is able to produce various options of PHA materials from crude palm kernel oil and palm oil mill effluent. Indonesia’s Selim Group is mulling the prospects of converting algae to biobased products. Cassava and sugarcane has been a major focus as a feedstock in Thailand. Thailand is the world's largest cassava exporter and second-largest sugar exporter. PTTMCC Biochem- a joint venture between PTT PLC and Mitsubishi Chemical, has selected BioAmber Inc. as its partner for a polybutylene succinate (PBS) plant in Thailand. Investments by PTT Chemical in Myriant will provide an impetus to biosuccinic acid in Thailand. PTT Group has become the world's leading player in the biobased petrochemical industry after its subsidiary PTT Chemical reached an agreement to acquire half of NatureWorks, the world's only manufacturer of polylactic acid (PLA). Thailand is on a strategic agenda to be the bio-based manufacturing center for the region and the globe-laying impetus and investment into infrastructure, man power and incentives. In India, major developments have been made in developing sugarcane as feedstock, while investment in jatropha has yet to pay off. Seaweed-oriented research to make ethanol and biobutanol is on the rise in South Korea. Vietnam, like Thailand, is largely cassava country when it comes to all things biobased although cane and aquaculture development are making strides. Arkema SA acquired two Chinese companies as part of a plan to grow its sales by 1 billion euros through acquisitions- a 100% stake in Hipro Polymers and Casda Biomaterials at US$365 mlnn. The former is a maker of biosourced nylon 10.10, and the latter a producer of sebacic acid derived from castor oil, a building block of Hipro's materials. Chinese domestic consumption for bioplastics will also grow rapidly, but will be constrained by Chinese government concerns with using food crops for feedstocks. Mexican company Biofase plans to develop 100% biodegradable plastic resins using avocado discarded seeds. Mexico is one of the biggest avocado producers, discarding about 30,000 tons (MT) of seeds a month. T

However, several factors can hold back the potential of biorenewable materials in Asia Pacific. Prices remain high, since application and technology development is an ongoing process. The low scale-up of manufacturing capacity also increase per unit costs. In addition, bioplastics' inferior performance attributes, such as moisture absorption, low heat deflection temperature, and reduced resistance against chemical attacks, limit their application range. The poor execution of eco-labeling policies and insufficient composting facilities in Asia-Pacific countries also restrict the potential applications of bioplastics. For the time being, bioplastics are playing a limited role in packaging and in the plastics market overall. However, manufacturers are sure to keep their eye on plant-based materials as a means to increase the sustainability of the value chain. Meantime, bioplastics manufacturers would do well to seek out applications at margins where their product can provide “good enough” performance at lower cost, or environmental benefits at equal cost or at a premium. This can provide a wedge into the market while producers expand capacity and improve their products through intensive R&D. As per Frost & Sullivan, to stimulate growth, manufacturers must innovate technology, develop better products, and scale-up capacity to bring per unit costs down. To encourage companies to enter the market, local governments should introduce codification for composting and biodegradability, and implement national standard certifications. This will enable the bioplastics market in Asia-Pacific to attract investments and grow steadily.