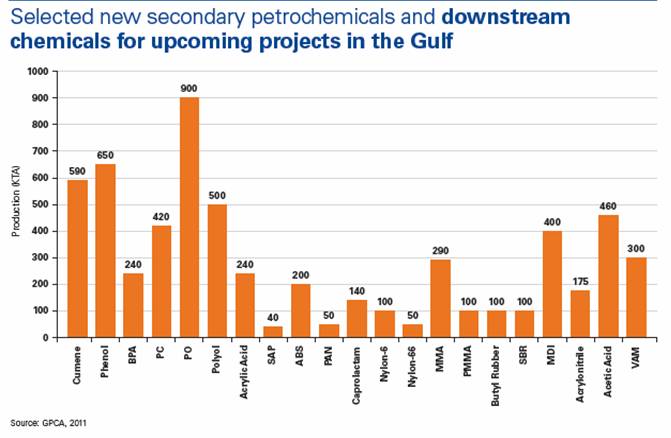

The Middle East is exposed to economic instability due to the increased dependence on the oil sector and it has been continuously trying to diversify its sources of income by developing downstream petrochemicals industry. As per a report by GlobalData, the oil sector contributes to a large portion of the GDP in the Middle East and sudden price fluctuation affects the revenues generated from the sector. To reduce their dependence on the oil sector, countries in the Middle East embarked upon diversification of their economy which led to the foundation of a strong basic petrochemicals (upstream) industry in the start of last decade. Now the region is moving a step ahead and encouraging the downstream petrochemicals industry which will further enhance the plastic resins production. The Middle East already has a large downstream petrochemicals industry and this move will further boost the downstream petrochemical capacity in the region. Diversification drive will also encourage the plastic processing industry which is currently very small and scattered. Capacity for many of the high value plastics such as acrylonitrile butadiene styrene (ABS), ethyl vinyl acetate (EVA) and polycarbonate is also expected to increase in next five years. By 2016, ABS, polycarbonate and EVA capacity in the region will reach to 0.283 mln metric tons per annum (MMtpa), 0.285 MMtpa and 0.345 MMtpa respectively. The downstream petrochemicals industry in the Middle East will rely on Asian demand to absorb these petrochemical capacities. Asia and Europe are the two largest plastic resins importer from this region. Producers in this region will target Asian markets due to the higher demand growth in these markets. Asian countries, especially China and India are supporting the downstream petrochemicals demand with their fast growing GDPs and large populations. China is already the largest importer of the downstream petrochemical from the Middle East and is expected to import huge quantities of downstream petrochemicals in the future also. Other major importers of downstream petrochemicals from the Middle East are Singapore, Turkey, Belgium and India. China's share in downstream petrochemicals imports is much higher due to the indirect consumption which occurs via Singapore which has established itself as the transshipment hub in the Asian petrochemicals industry. Turkey also imports one third of its downstream petrochemicals from the Middle East.

Saudi Arabia and Iran are the two largest petrochemical exporters in the region. Saudi Arabian ethane has the lowest cost in the Middle East region. This feedstock subsidy makes Saudi companies the global low cost producers of downstream petrochemicals. Due to this production and exports of major plastics from Saudi Arabia has increased substantially. Iran has the second largest petrochemicals industry in the region and is growing at a fastest pace. It has the second largest natural gas reserve in the world which provides both energy and petrochemical feedstock to the producers. Both these countries are leading the Middle East downstream diversification drive and continuous government support will help them to enhance their competitiveness in the global downstream petrochemical industry. To take advantage of the downstream diversification drive many companies in the region have taken initiatives. Saudi Aramco and Dow Chemicals Company have entered into a joint venture to establish Sadara Chemical Company which will construct a mega petrochemical complex in Saudi Arabia with various plastics production units. Iran Petrochemical Commercial Company will also benefit from the diversification drive since polymers is the second largest revenue generating segment among all the petrochemicals exporting segments. The Qatar Petrochemical Company has already planned three downstream petrochemical complexes and is has just entered into a JV with Qatar Petroleum to construct polyethylene and polypropylene plants in Ras Laffan.

As per a report by KPMG and GPCA, the opportunity to grow with the huge demand for commodity and downstream derivative chemical products in the Middle East faces challenges that have to be met and overcome. Global competition is intensifying – shale gas is a game-changer for North American competitiveness and the development of coal-based technologies such as MTO in Asia may fundamentally impact import needs. While GCC producers will maintain their global cost-advantage, low cost ethane feedstock is tight. The move to heavier feedstocks and, typically, a 20% premium on US Gulf Coast benchmark capital plant construction costs will reduce margins. Geo-political tensions are high, with the risk of protectionism greater and confidence uncertain in a post-stimulus world. Volatility plagues the certainty sought by financial investors and attempts to rein in inflation in overly-stimulated economies could lead to a hard-landing in some of the largest chemical markets in the world. More regionally, social unrest has temporarily impacted local markets while the human costs of piracy in the Indian Ocean remain as concerning as the financial costs to the region’s vital supply chain links to Asia, Europe and beyond. Also, the GCC region has relatively small local markets, but GCC petrochemical producers are geographically closer to Asian markets than their competitors in Europe and the US. In some cases, they can leverage long-standing business relationships as a feedstock supplier and partner in joint ventures. Asia’s growing demand for middle class products will therefore remain a strategic driver for GCC downstream development. Over the coming years, Gulf producers will be competing more intensively to successfully capture downstream demand in the emerging markets. Each region is starting this race with different strengths and weaknesses and it is the region that best leverages their existing strengths that is likely to be successful. Like many GCC chemical companies, Chinese chemical majors benefit from government support and funding, but the sheer size and proximity of local markets in China will remain a key competitive advantage over the Gulf. At the same time, Chinese companies face significant challenges in terms of higher priced and less accessible petrochemical raw materials and a lack of advanced technology for downstream products. Diversifying its petrochemical feedstocks away from naphtha to coal will not be without its challenges.