| Type | % Share |

| Themoplastic | 75 |

| Thermoset | 15 |

| Composite | 9 |

| Other | 1 |

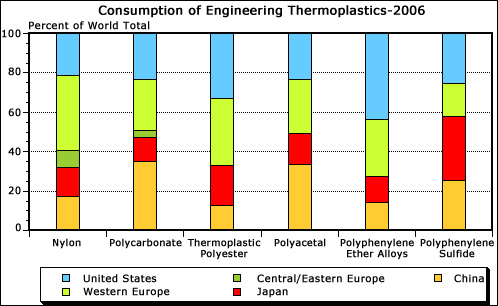

75% consumption of the major 5 ETPs- Polyamide, PC, PET, PPO/PS blends and POM, is in North America (40%) and Europe (35%). Asia including Japan accounts only for 25% market. The electrical/electronic industry is an important market of ETP. Flame retardant property is the prime important requirement of the electrical/electronic industry. Most of the plastic parts in these applications are required to be flame retardant. The E/E market requires materials/parts for new products to be evaluated against UL (Underwriters Laboratories) requirements. In Europe, RoHS (Restriction of Hazardous Substances) in E/E equipment and WEEE (Waste Electrical and Electronic Equipment) directives also mandate that flame resistance be achieved without the use of halogenated components. Limiting temperature index (LTI) is also an important UL requirement that specifies the maximum continuous use/operating temperature for a material. ETP has a good growth prospects for electrical/electronic market.

A report by SRI Consulting focuses on the compounding of such engineering thermoplastic (ETP) resins as nylons, polycarbonates (PC), polyphenylene ethers (PPE), polyesters, polyacetals and polyphenylene sulfides (PPS). The report does not discuss the compounding of commodity resins, such as acrylonitrile-butadiene-styrene (ABS), polyvinyl chloride (PVC) or polyolefins, or high performance plastics, such as polysulfone, polyetherimide and polyetheretherketone. However, most compounders, especially independents that purchase resin on the merchant market, often compound both commodity resins and ETP resins. ABS resins are considered by many compounders to be engineering resins with many applications similar to those of the resins. A variety of modifiers can be incorporated into plastics, including fibers, mineral fillers, reinforcements, impact modifiers and pigments. Engineering thermoplastics are sometimes blended. Blending one polymer with another can produce attractive alternatives to costly, overengineered plastics and inexpensive but underengineered materials. Alloys are special classes of blends that exhibit homogeneous structures and usually display properties superior to those of conventional blends. In most cases, specially designed compatibilizing agents must be added to the polymer blend to improve the miscibility of the polymers.

The following chart shows consumption of engineering thermoplastics by type. These regions account for 90% of total world consumption.

Transportation and electrical/electronic applications account for the majority of ETP consumption. The transportation market includes automotive, truck/bus, motorcycle, marine and aerospace applications. All electrical/electronic components used in vehicles are included in the transportation market segment. Consumption in this segment is driven largely by the automotive industry and represents approximately a 30-35% market share. The E/E market includes electromechanical (e.g., coils, bobbins, relays) and electronic components (e.g., connectors, sockets, switches), as well as business equipment housings (market share of 25%). Consumer end uses (with a 10% share) include lawn and garden equipment, power tools, office furniture, sporting goods, toys and miscellaneous products (e.g., pens, lighters, picture frames). Industrial applications (market share of 15%) include lighting/glazing, material fluid handling equipment and plumbing/irrigation components.

Finding and filling niches is an important factor for success in the compounding of engineering thermoplastics. Innovative niche development is a prime reason for the success of one compounder over another. Reliable delivery is extremely important to both the processors of ETP compounds and the original equipment manufacturers (OEMs) they serve. Successful compounders usually maintain excellent technical service capabilities and/or technically oriented salespeople to assist processors and OEMs with specifications, materials selection and problem solving. Large international OEMs are increasingly interested in limiting the number of their suppliers to increase efficiency through improved coordination and to increase the participation and commitment of suppliers to product development. Multiple plant locations and stocking points allow fast delivery and optimize service to regional customers. Just-in-time (JIT) production and delivery are becoming more important